In Australia’s fast-moving digital economy, protecting customer data isn’t just good practice—it’s a business imperative. For any company that handles card payments, the *Payment Card Industry Data Security Standard (PCI DSS)* is the benchmark for security.

But facing a *Qualified Security Assessor (QSA) audit* can feel overwhelming. Where do you start? How do you ensure you pass without pulling your hair out?

This guide breaks down the process into clear, manageable steps to help your Australian business prepare for a smooth and successful PCI DSS audit.

Australia has seen rapid growth in digital transactions alongside rising cyber threats. Credit card fraud remains a serious issue, with attackers constantly devising new ways to steal information. In this environment, complying with the Payment Card Industry Data Security Standard (PCI DSS) is not optional – it’s mandatory for any business that processes, stores, or transmits cardholder data, regardless of size. Compliance protects your right to accept card payments through your bank and avoids costly fines and fees that can result from data breaches or lapses in security.

PCI DSS compliance is enforced contractually by payment brands via your acquiring bank. If you handle card payments – whether you’re a retail chain processing POS transactions, a financial institution handling credit card info, a telecom offering online bill payments, or a payment processor serving merchants – you must meet PCI DSS requirements to continue operations smoothly. Non-compliance can lead to penalties or even losing the ability to process cards, not to mention damaging customer trust and brand reputation.

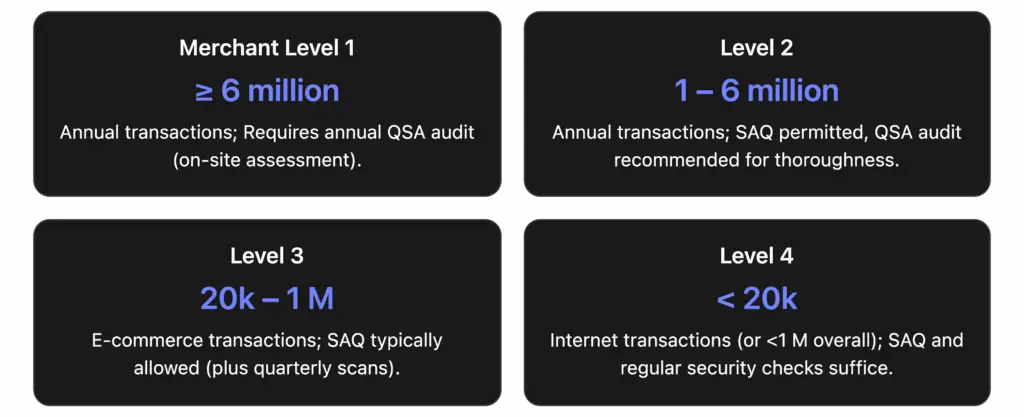

Qualified Security Assessors (QSAs) play a pivotal role in this landscape. A QSA is an individual or company certified by the PCI Security Standards Council to conduct PCI DSS audits and validate compliance. If you are a Level 1 merchant or service provider (processing large volumes of transactions) in Australia, you’ll typically need an annual on-site audit by a QSA to maintain compliance. Smaller businesses might self-assess using the PCI DSS Self-Assessment Questionnaire (SAQ), but even then, preparing as if an external audit were coming is a wise strategy to ensure nothing is overlooked.

This article serves as a practical step-by-step guide to help Australian businesses fully prepare for a PCI DSS QSA audit. We’ll cover everything from understanding the requirements and setting the scope, to conducting internal checks, engaging a QSA, and maintaining compliance post-audit. Along the way, we’ll reference Australian cybersecurity firms like Cianaa Technologies that offer PCI compliance services, and provide tips on using lead-capturing tactics (such as checklists and consultation offers) to add value for readers. Let’s dive in.

Before jumping into preparation steps, it’s important to clarify what a PCI DSS QSA audit entails and why it’s crucial for businesses handling payment cards:

PCI DSS (Payment Card Industry Data Security Standard) is a set of 12 comprehensive security requirements established by the major credit card companies to protect cardholder data. These requirements are grouped under six core objectives (ranging from maintaining secure networks and protecting data, to implementing access control and maintaining security policies) and apply to any organization that accepts or processes payment cards.

QSA (Qualified Security Assessor): A QSA is an independent security professional or firm certified by the PCI Security Standards Council to assess and validate an organization’s adherence to PCI DSS. In other words, QSAs are the auditors who conduct official PCI DSS compliance assessments. They review your technical and operational controls, verify that you meet all requirements, and ultimately issue a Report on Compliance (ROC) if you pass the audit.

Audit vs. Self-Assessment: Depending on your business’s size and transaction volume (often referred to as merchant level), you may either be required to undergo a QSA-led audit or allowed to self-certify via the SAQ. For instance, Level 1 merchants (processing over 6 million transactions/year or those who have had a breach) must have an annual external assessment by a QSA. Levels 2–4 (smaller volumes) can often use the SAQ, but many still opt to work with QSAs or consultants to ensure nothing is missed. The table below summarizes merchant levels and typical validation requirements:

Before you do anything else, you must define your Cardholder Data Environment (CDE).

What it is: This includes every part of your network and any system that stores, processes, or transmits cardholder data.

Why it matters:The audit only applies to the systems in your CDE. A common mistake is poorly defined scope, which can drag unrelated, unsecured systems into the audit, making it vastly more complex and expensive.

Your Action: Create a precise network diagram and data flow map. Know exactly where card data comes in, where it rests, and how it moves. Be ruthless in segmenting your network to keep the CDE as small and isolated as possible.

Don’t wait for the auditor to find your problems. A gap analysis is your internal pre-audit, where you compare your current security controls against each of the 12 PCI DSS requirements.

Be Honest:This is the time for critical self-assessment. Where are you falling short? Are your patches up to date? Are access controls truly based on a “need-to-know” basis?

Document Everything: Note every gap you find, no matter how small. This list will become your remediation roadmap.

This is where the hard work happens. Take your gap analysis report and fix the issues. Key areas to focus on include:

Patching: Ensure all systems in scope are patched and updated.

Access Control: Enforce strong, unique passwords. Implement multi-factor authentication (MFA) for all remote access into the CDE. Remove any old or shared user accounts.

Encryption: Verify that all stored cardholder data is encrypted and that data is transmitted securely (e.g., using up-to-date TLS).

Logging: Turn on detailed logging for all systems in the CDE and make sure those logs are reviewed regularly.

If it isn’t written down, it didn’t happen. A QSA audit is as much about checking your documentation as it is about checking your systems. You must have clear, formal policies and procedures for everything.

Key Documents: This includes your Incident Response Plan, security policies, access control procedures, and daily operational checklists.

Evidence is King: Be prepared to provide evidence for everything. Gather screenshots, configuration files, system logs, and staff training records. Organise this in a central, accessible location before the auditor arrives.

Choosing the right QSA is crucial. Look for a partner who understands your industry and the specific Australian business landscape.

During the Audit: Be organised, cooperative, and transparent. Assign a dedicated point of contact from your team to liaise with the QSA and quickly provide any requested evidence.

Be Responsive: If the auditor finds a minor issue, you may be able to fix it on the spot. Having your IT team on standby can be a lifesaver.

Passing your PCI DSS audit is a major achievement, but it’s not the end of the journey.

Compliance is an ongoing process, not a once-a-year project.

The security measures you’ve implemented must be maintained every single day. Continuous monitoring, regular scanning, and fostering a security-aware culture are essential to protecting your data, your customers, and your brand’s reputation in the Australian market

If your business processes credit or debit card payments, PCI

PCI DSS QSA audit Australia — In today’s digital economy,

Acknowledgment The authors would like to thank the broader cryptography